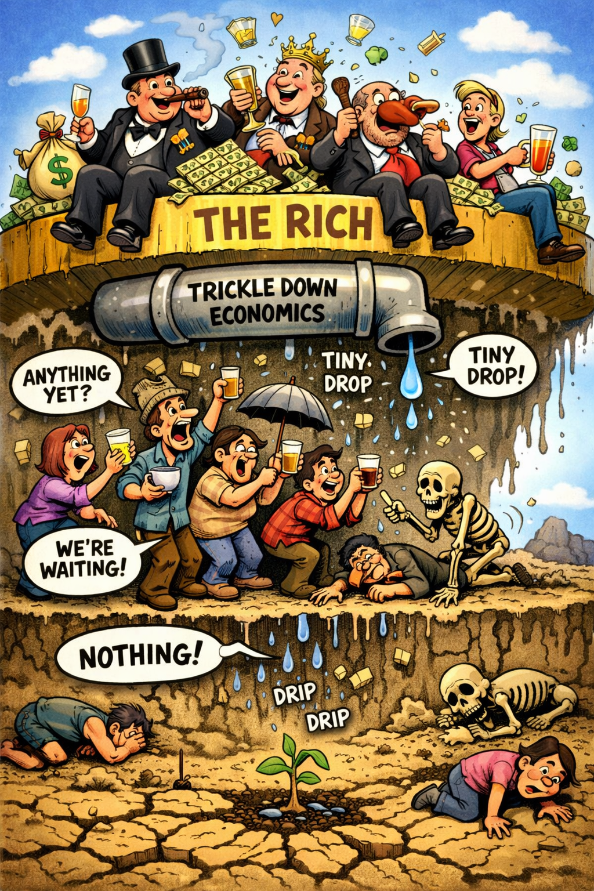

If someone tells you tax cuts for the rich will boost the economy for everyone, they may be dishonest but we adhere to Hanlon’s razor and shan’t attribute to malice, without cause, that can be attributed to ignorance, stupidity or incompetence.

The actual peer-reviewed research tells us a different story.

When the top 20% get richer GDP decreases. When the bottom 20% increase income GDP rises.

This is not a detailed article or analysis, it is just a starting point for those serious about the topic to actually review relevant and respected peer-reviewed materials.

Hope & Limberg (2022)

This study analyzed 50 years of tax policy across 18 wealthy nations. Published in Socio-Economic Review, their findings: tax cuts for the rich increased inequality with zero meaningful effect on unemployment or growth.

IMF Staff (2015)1

This one isn’t peer reviewed its an internal document but a panel of experts that examined 150 economies globally. Lots of interesting findings but bottom line, when the top 20% get richer, GDP growth actually decreases. When the bottom 20% gain income, growth increases. The verdict: “benefits do not trickle down.”

Piketty, Saez & Stantcheva (2014)

published in the American Economic Journal found that top tax rate cuts correlate with higher CEO pay but not economic growth. The mechanism: executives bargain more aggressively for their own compensation at workers’ expense.

Altunbaş & Thornton (2018)

analyzed 65 countries from 1995-2011 in Development Policy Review. Their conclusion: income transfer from poor to rich is more dominant than the reverse, demonstrating the invalidity of trickle-down effects.

These aren’t pseudo-intellectual think-tank papers with no accountability or transparency – these are real studies with data, methodology and transparency.